What Global Fund Flows Tell Us About the Future of Scaling Innovators (and How LeverVenture Fits In)

Global fund flows aren’t just abstract financial metrics—they’re powerful indicators that reveal where smart money is moving and why. For scaling innovators and the investors who back them, these signals offer a roadmap to future opportunities and challenges in the capital markets.

At LeverVenture, we’ve been tracking these patterns closely, not just as observers but as active participants in shaping how growth capital reaches the most promising companies. The story these flows tell is both compelling and consequential for anyone building or investing in tomorrow’s market leaders.

Reading Between the Lines: What Fund Flows Reveal About Innovation Capital

The last 24 months have witnessed seismic shifts in how capital moves through the global economy. According to recent Preqin data, growth-stage funding has experienced significant volatility, with quarterly fluctuations of 30-40% becoming the new normal. These patterns aren’t random—they reflect deeper structural changes in how investors evaluate risk and opportunity.

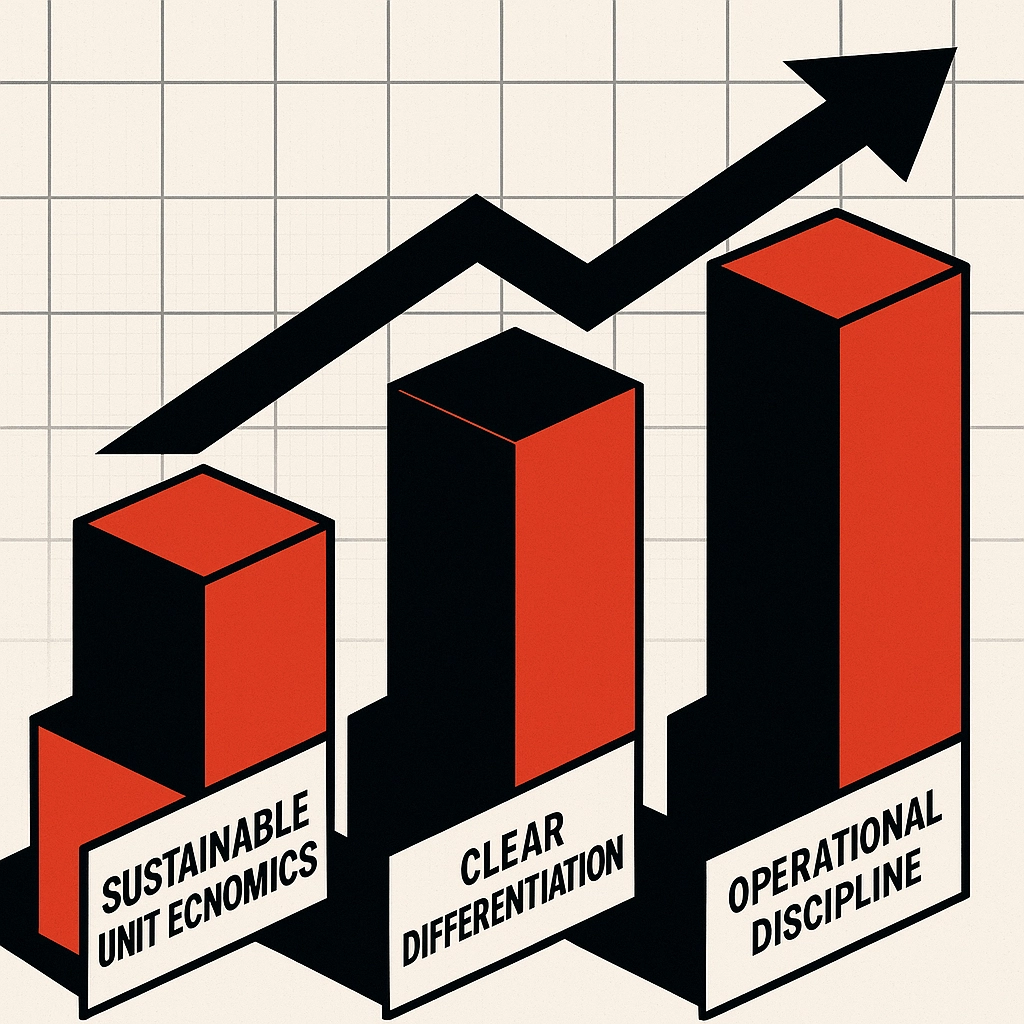

Most notably, we’re seeing a pronounced flight to quality. The days of undifferentiated capital chasing any company with a plausible growth story are firmly behind us. Instead, investors are channeling resources toward companies that demonstrate three key characteristics: sustainable unit economics, clear differentiation, and operational discipline.

This selectivity is evident in the numbers. While overall venture deployment has contracted by roughly 18% year-over-year, growth equity allocations to companies with proven product-market fit and positive contribution margins have actually increased by 11%, according to the latest PitchBook Growth Equity Report.

The Geographic Rotation: Cross-Border Capital Is King

Perhaps the most intriguing development is the increasingly borderless nature of growth capital. Traditional geographic boundaries that once dictated investment patterns are dissolving, driven by several factors:

- Remote work has normalized distributed teams and cross-border collaboration

- Regulatory harmonization has reduced friction for international scaling

- Localization technologies have accelerated global go-to-market strategies

The data tells the story: cross-border growth investments have increased from 22% to 37% of all deals above $20M in the past three years. This isn’t just American investors looking abroad—we’re seeing robust bidirectional flows between the US, Europe, and selective Asian markets.

For scaling innovators, this means opportunity isn’t constrained by geography. A company headquartered in Boston can leverage expertise from Berlin, capital from California, and market expansion strategies for Singapore—all within the same growth round.

The Value-Add Imperative: Beyond Passive Capital

Fund flows also reveal another critical evolution: the rising premium placed on operational expertise. When we analyze post-investment performance, companies backed by operationally-engaged investors consistently outperform their peers by 2.3x in revenue growth and 1.8x in valuation multiples.

This is precisely why we’ve built LeverVenture’s model around the principle that growth capital must include operational value creation. Our Lever Solutions platform isn’t an afterthought—it’s core to how we help scaling companies accelerate from Series B through exit readiness.

The numbers validate this approach. According to a recent Harvard Business Review study, companies that access operational expertise alongside growth capital are 76% more likely to achieve their three-year growth targets compared to those working with passive investors.

Sector Rotation: Where Tomorrow’s Capital Is Flowing

Fund flows also provide a forward-looking view into which sectors are gaining investor attention. While technology broadly remains attractive, we’re seeing notable sub-sector rotation that suggests where scaling opportunities may be richest:

- AI Infrastructure: Companies building the foundational tools and systems that make AI deployment practical and scalable are seeing unprecedented inflows

- Healthcare Technology: The intersection of software, data, and care delivery continues to attract premium valuations

- Financial Infrastructure: Next-generation payment, identity, and financial management systems are seeing robust demand

- Climate Tech 2.0: Following earlier disappointments, climate technologies with clear unit economics and near-term ROI paths are regaining investor confidence

This aligns perfectly with LeverVenture’s sector focus, where we’ve been particularly active in backing companies at the intersection of software, data intelligence, and critical industries like healthcare, financial services, and enterprise operations.

The Middle-Market Advantage: Finding the Sweet Spot

Perhaps the most actionable insight from current fund flows relates to deal size and company stage. We’re witnessing what might be called a “middle-market renaissance” in growth equity.

While mega-funds continue raising larger vehicles, deployment has become challenging at the extremes of the market. Seed and early-stage deals often lack the scale these funds require, while the competition for established late-stage companies drives valuations to levels that compress potential returns.

This has created a sweet spot for companies raising between $15M and $50M—precisely where LeverVenture focuses. These businesses have typically proven their product-market fit and business model but haven’t yet attracted the intense competition that drives irrational pricing in later stages.

How LeverVenture’s Approach Maps to These Trends

Understanding these fund flow patterns isn’t just an academic exercise—it directly informs our investment and value-creation strategy at LeverVenture. Our approach is purpose-built to capitalize on these trends:

Cross-Border Perspective: Our investment team and operating partners span multiple geographies, giving us natural advantages in identifying and supporting companies with global potential.

Operational Value-Add: Through our Lever Solutions platform, we don’t just provide capital—we deliver hands-on expertise in go-to-market optimization, talent acquisition, and operational scaling.

Middle-Market Focus: We’ve deliberately structured our funds to target the underserved middle market, where capital gaps create attractive entry points for investors who can add meaningful value.

Sector Expertise: Our investment themes align precisely with the sectors experiencing the most promising fund flows, particularly in enterprise technology, healthcare innovation, and financial infrastructure.

Looking Ahead: What’s Next for Growth Investors and Scaling Companies

As we look to the next 12-24 months, several trends appear likely to shape growth funding:

Consolidation Will Accelerate: Mid-stage companies with complementary capabilities will increasingly combine to achieve scale and efficiency.

Private Remains Preferred: Despite public market improvements, many growth-stage companies will opt to stay private longer, creating extended runways for private investors.

Operational Metrics Will Dominate: Growth at all costs is firmly out; investors will prioritize companies demonstrating operational excellence alongside expansion.

Regional Ecosystems Will Strengthen: Secondary markets outside traditional venture hubs will continue gaining prominence as viable scaling environments.

For scaling innovators, the message is clear: build with operational discipline, prepare for a cross-border future, and seek investors who bring more than just capital to the table. The companies that align their growth strategies with these fund flow realities will find themselves advantaged in accessing the resources needed to become category leaders.

At LeverVenture, we’re committed to being the partner of choice for precisely these types of companies—those with the vision to see where markets are heading and the execution capability to get there first. The future belongs to companies that can read these signals and position themselves accordingly.

This post is part of our ongoing analysis of growth capital markets and scaling strategies. For more insights on operational value creation in growth-stage companies, see our previous analysis on Beyond Capital: Operational Value-Add in Competitive Markets.